Solo Living or Roommate Life in Canada (2025): Can You Really Afford to Live on Your Own?

Thinking about getting your own place and ditching the roommate lifestyle? If having your own space, kitchen, and Netflix queue sounds like freedom—you’re not alone. But in today’s rental market, going solo might be more of a luxury than a lifestyle.

Let’s break it down:

- How much extra it costs to live alone in Canada

- Signs you’re financially ready for the leap

- Where in Canada solo living is doable (and where it’s a stretch)

- The 30–40% budget rule

- How iROOMit can help if shared housing is still your best bet

What’s the Real Cost of Living Alone in Canada?

With rising apartment rental prices across the country, solo living in major cities is becoming less affordable—especially for young professionals, students, and newcomers.

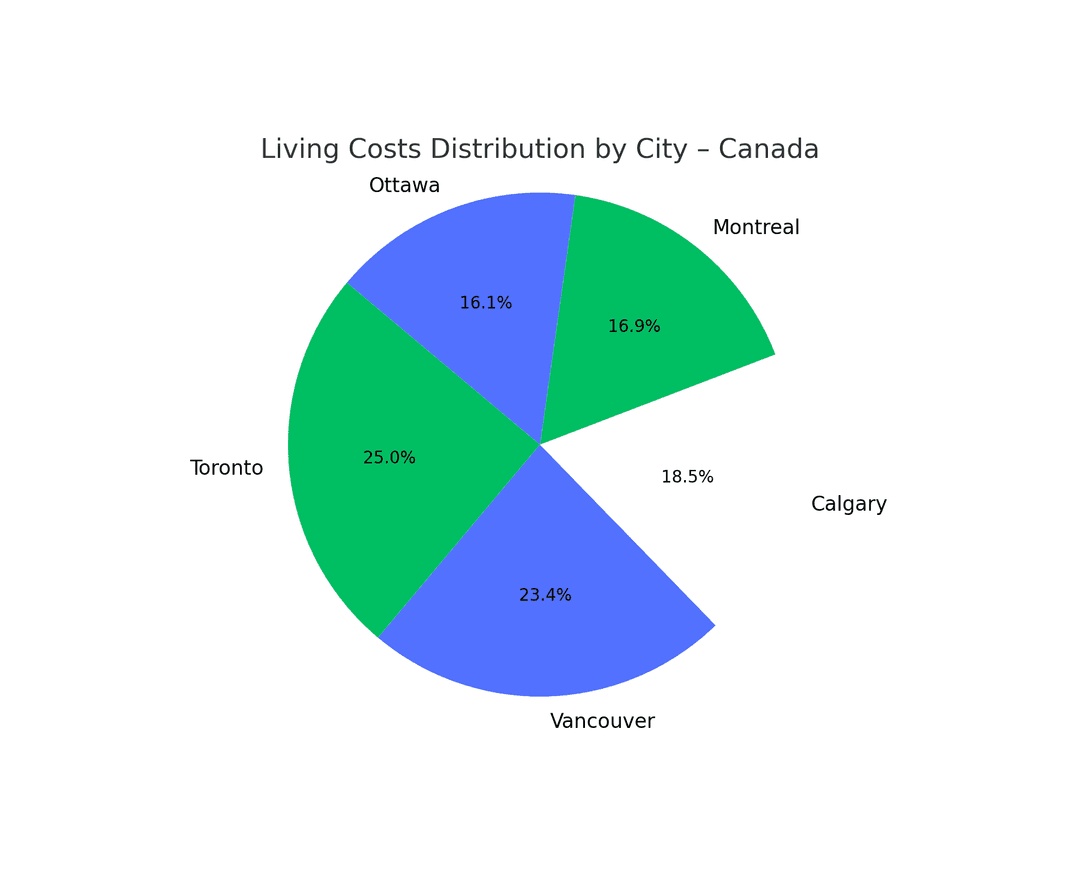

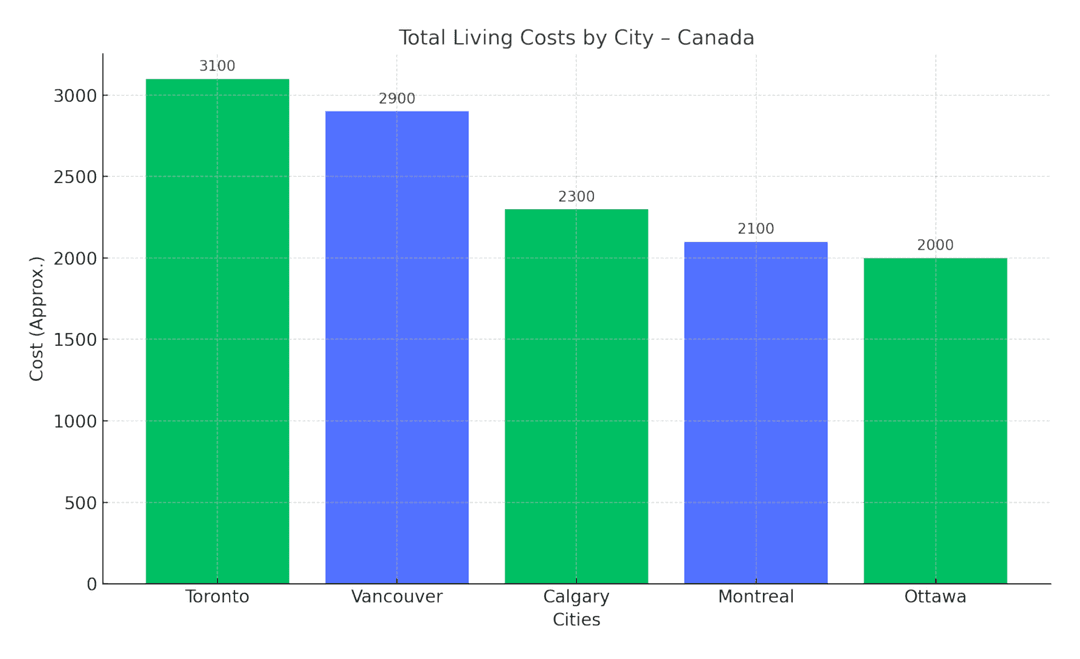

According to 2024 data from Rentals.ca, here’s what solo renters are facing:

🏠 Average 1-Bedroom Rent (Major Cities):

- Toronto: $2,620/month

- Vancouver: $2,950/month

- Montreal: $1,700/month

- Calgary: $1,720/month

- Ottawa: $2,100/month

- Halifax: $1,850/month

🛏️ Average Shared Room Rent:

- Toronto/Vancouver: $900–$1,400/month

- Montreal/Calgary: $700–$1,000/month

- Other cities: $600–$900/month

📈 Bottom Line: Living alone in Canada can cost you 40–60% more than living with roommates. And that’s just rent—utilities, Wi-Fi, and other solo expenses add another $200–$400/month.

Are You Financially Ready to Go Solo?

Here’s how to know if you’re ready to move into your own place:

✅ Rent Is Under 35% of Your Monthly Income

Experts suggest keeping rent below 30–35% of your take-home pay. So if you're earning $5,000/month after tax, your rent shouldn't exceed $1,750—which rules out solo living in many cities unless you have a high income or choose an affordable suburb.

✅ You Can Handle Full Utilities & Internet

When you live alone, you’re footing the full bill for everything:

- Hydro

- Internet

- Heating (especially important in winter)

- Tenant insurance

Expect to pay an additional $250–$400/month when living alone.

✅ You Have Savings for Furniture & Move-In Costs

Most leases require first and last month’s rent, plus deposits. And if you're starting from scratch, furnishing a basic one-bedroom could cost $3,000–$5,000+.

✅ You’re Earning Steady Income

Job security matters. A sudden loss of income while solo could be much more financially devastating than if you’re splitting expenses with roommates.

Cities Where You’ll Probably Need Roommates

Toronto

- 1-bedroom: $2,620/month

- Shared room: $1,200/month

Solo living in the GTA requires a $75K+ annual income just to stay afloat. For most young professionals, roommates are still the norm.

Vancouver

- 1-bedroom: $2,950/month

- Shared room: $1,300/month

One of Canada’s priciest rental markets. Living alone is a financial stretch unless you're earning six figures or living far from the city core.

Ottawa

- 1-bedroom: $2,100/month

- Shared room: $950/month

The capital city is catching up to Toronto and Vancouver in rental prices, making shared living the more economical choice—especially near universities or government hubs.

Cities Where Solo Living Might Work

✅ Montreal

- 1-bedroom: $1,700/month

- Shared room: $800/month

Montreal offers some of Canada’s most affordable big-city rent. With good income and budgeting, solo living here is realistic—even in central areas.

✅ Calgary

- 1-bedroom: $1,720/month

- Shared room: $900/month

Rental prices are still relatively low, especially compared to incomes in energy and tech sectors. Solo living is viable for mid-income earners.

✅ Halifax

- 1-bedroom: $1,850/month

- Shared room: $850/month

As the city grows, prices are rising—but the solo lifestyle is still within reach for locals and remote workers with steady salaries.

✅ Winnipeg / Edmonton / Saskatoon

- 1-bedroom: $1,100–$1,500/month

These prairie cities offer the best value in the country. If you're earning over $3,500/month, living alone is not only possible—but comfortable.

The 30–40% Rule: How to Know If You’re Ready

Use this simple budgeting formula:

👉 If you currently spend $900/month on rent in a shared space, can you afford $1,300–$1,400/month plus utilities and still save?

If yes—you may be ready to live solo.

If no—or if the increase will stretch your finances thin—it might be better to wait, increase your income, or split costs a bit longer.

Final Thoughts

Living alone in Canada is an exciting goal—but not always a realistic one, especially in high-cost cities. The extra freedom comes with a steep price tag, so it’s essential to plan ahead, budget wisely, and know your financial limits.

Still need to split the rent for now? No problem. With iROOMit, you can find reliable, like-minded roommates and shared homes in your city—without endless browsing or awkward interviews.

🔍 Ready to find a roommate in Canada? Start now by downloading iROOMit app