Solo Living or Roommate Life in Singapore (2025): Can You Really Afford to Live on Your Own?

Tired of squeezing into shared flats or dealing with roommates quirks? Dreaming of your own peaceful space in the city? Living alone in Singapore definitely sounds like a lifestyle upgrade—but is it one your budget can handle?

Let’s explore:

- The real cost of living alone in Singapore

- Signs you’re financially ready to go solo

- Areas where you can (or can’t) afford to live alone

- The 30–40% budget rule

- And how iROOMit can help if shared living still makes the most sense

How Much More Does It Cost to Live Alone in Singapore?

Singapore is one of the most expensive cities in Asia when it comes to housing—especially if you're a single expat, young professional, or student renting on the private market.

Here’s what you can expect:

🏠 HDB Rentals (Public Housing):

- 1-room or 2-room HDB flats: SGD 2,000–2,800/month

- Common room in shared HDB flat: SGD 850–1,300/month

🏢 Condos (Private Housing):

- 1-bedroom condo unit: SGD 3,200–4,000/month

- Shared room in a condo: SGD 1,200–1,800/month

Living solo means you're shouldering 100% of the rent, utilities (electricity, water, gas), Wi-Fi, and any maintenance fees. You’ll also likely need to furnish your space, which adds SGD 4,000–6,000 upfront if you’re starting from scratch.

📊 Bottom line? Living alone in Singapore increases your monthly housing costs by around 40–60% compared to shared living.

Are You Ready to Live Alone?

Before you jump into a solo lease, here’s how to tell if your finances are ready:

✅ Rent Is Under 35% of Your Net Income

Singapore’s financial advisors generally recommend keeping rent below 30–35% of your take-home pay. For example, if you make SGD 6,000/month, your rent budget should be under SGD 2,100/month—tough if you want a solo flat in central areas.

✅ You Can Handle Utilities & Internet

Expect to pay SGD 150–250/month extra in utilities, internet, and cleaning if you’re living solo. Shared flats divide these costs, often making them significantly more manageable.

✅ You Have Enough Saved for Setup Costs

If you’re renting your own place, you’ll need to budget for a security deposit (1–2 months), first month’s rent, plus furniture, appliances, and moving costs—adding up to SGD 6,000–8,000+ easily.

✅ You Have Job Stability or Passive Income

Singapore’s rental contracts usually require a 1- or 2-year commitment. Having a stable job or long-term visa/residency is critical before signing a solo lease.

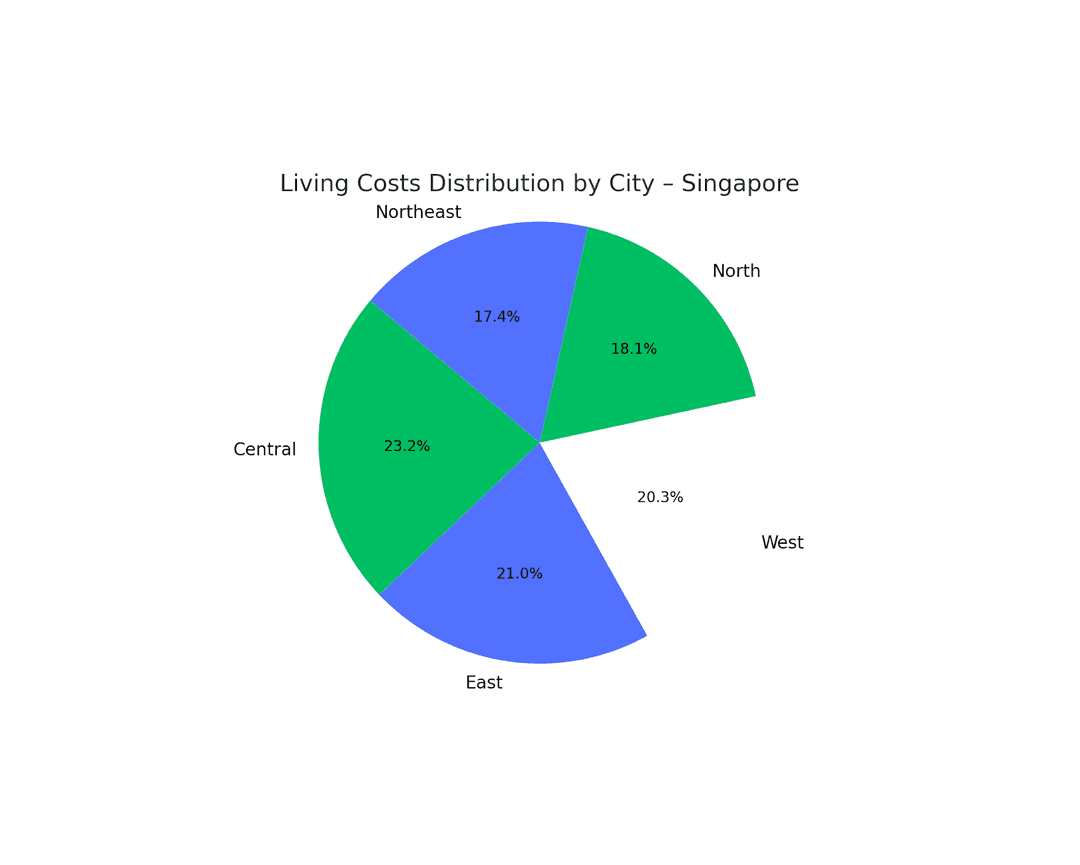

Where in Singapore Is Solo Living Actually Realistic?

Expensive, Solo-Living-Is-Tough Areas

- Tanjong Pagar / Marina Bay / Orchard: One-bedroom units range from SGD 4,000–6,000/month. Shared rooms are often the only option unless you're earning SGD 100K+/year.

- Bukit Timah / Holland Village: Popular with expats, but high demand = high rent. One-bedroom condos start at SGD 3,800/month.

✅ More Affordable for Solo Living

- Woodlands / Yishun / Sengkang: One-bedroom HDB or older condo rentals can be found for SGD 2,000–2,400/month. Still not cheap, but more manageable for mid-level earners.

- Jurong East / Pasir Ris / Bedok: Accessible by MRT and more budget-friendly, these areas offer solo options under SGD 2,500/month, especially in older HDB estates.

The 30–40% Rule: Are You Financially Set for Solo Life?

A simple budgeting formula:

👉 If you currently pay SGD 1,200/month in a shared room, make sure you can comfortably handle SGD 1,600–1,800/month or more before going solo.

That extra 30–40% needs to cover your higher rent and full utilities, groceries, and emergency expenses.

If increasing your housing budget means skipping savings, insurance, or even weekend hawker meals—solo living might be premature for now.

Final Thoughts: Shared Living Still Makes Sense for Many

Living alone in Singapore is a dream for many, but in 2025, it’s not the most budget-friendly option for most young people. Rising rents and limited solo-friendly housing make accommodation sharing a smart financial move—especially if you’re working towards bigger goals like saving for property, travel, or investing.

But when you’re ready to make the switch to solo living, plan ahead, budget smart, and know your numbers.

Need a reliable, easy way to find great flatmates or shared flats in Singapore? iROOMit is your go-to platform for safe, verified matches that fit your lifestyle, culture, and budget.

🔍 Start your roommate or rooms for rent search now Download iROOMit app