Solo Living or Roommate Life in the UK (2025): Can You Really Afford to Live on Your Own?

Thinking about ditching flatmates and living solo? Here's what you need to consider first.

Living alone isn’t just about having more privacy and personal space—it comes with a serious financial commitment. In this guide, we’ll explore:

- How much more it really costs to live on your own

- What signs show you're financially ready

- Cities where going solo is realistic—and where it’s nearly impossible

- How to plan using the 30–40% rule

- And how iROOMit can help if you’re sticking with flatmates

Let’s get into it.

How Much More Expensive Is Living Alone in the UK?

For many young adults across the UK—especially Gen Z—the dream of having your own place is becoming more out of reach. Rising rents, stagnant wages, and the cost-of-living crisis mean living alone is a luxury in most cities.

A 2024 report from ONS (Office for National Statistics) found that nearly 40% of renters aged 18–34 still share accommodation due to affordability challenges. For some, solo living doesn’t become viable until their early to mid-30s.

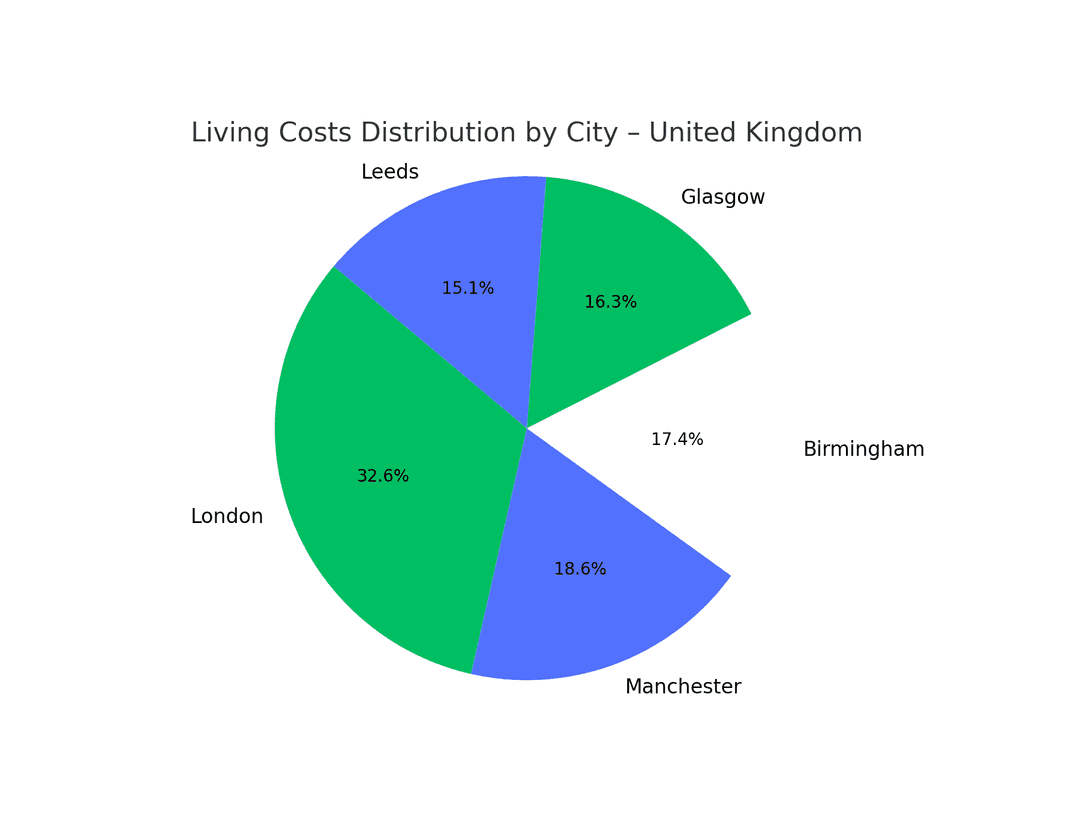

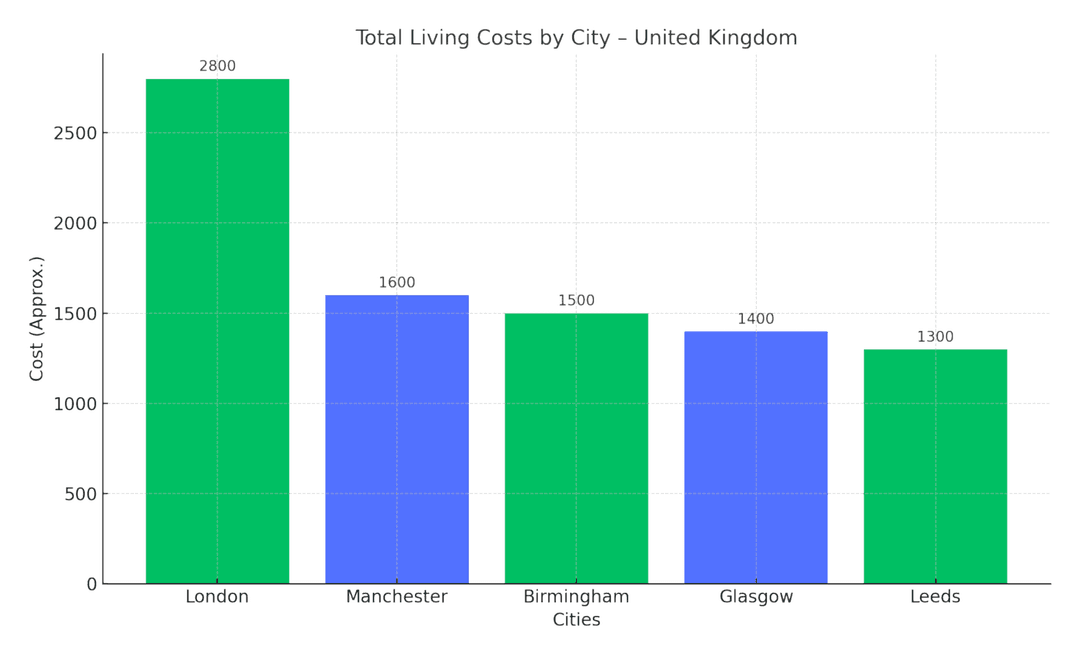

To understand the true cost, iROOMit analysed user data and housing trends in the UK. Across major cities, the results are clear: Living solo in the UK requires a budget increase of around 30–45% compared to sharing a flat.

For example:

- In London, a one-bed flat costs an average of £2,100/month, while a shared flat room costs about £950—a 121% increase to go solo.

- In Manchester, it’s £1,100 for a one-bed vs. £600 for a room—an 83% increase.

- Even in more affordable cities like Birmingham, solo living still means spending at least £300–£400/month more.

This gap includes rent, council tax (which you pay alone), utilities, and other essentials like broadband and water. Splitting bills with flatmates can save you hundreds.

How to Know If You’re Financially Ready to Live Alone

Wondering if it’s the right time to make the move? Here are signs you’re financially ready to ditch the flatmates:

✅ You Can Afford Rent Under 35% of Your Income

Money experts in the UK recommend spending no more than 35% of your take-home pay on rent. If your solo rent crosses that threshold, you're at risk of struggling with savings or unexpected expenses.

✅ You’ve Budgeted for Bills and Council Tax

Living alone means covering 100% of council tax, utilities, Wi-Fi, and TV licence. Combined, these can add £250–£400/month depending on location. Make sure you’ve budgeted accordingly.

✅ You Have Savings for Furniture & Moving Costs

Moving out solo? You’ll likely need £2,000–£4,000 upfront for first month’s rent, deposit, furniture, and moving costs. Avoid dipping into your emergency fund unless absolutely necessary.

✅ You’re Earning More or Spending Less

Whether it’s a salary bump, remote work that saves on commuting, or ditching subscription services, increasing your disposable income is key to making solo living sustainable.

✅ You Have Job Security

With rent and bills on your shoulders alone, career stability becomes crucial. If you're on a fixed-term contract or freelancing, make sure you’ve built up at least 3–6 months' living expenses.

Where in the UK Can You Actually Afford to Live Alone?

🌆 Tough for Solo Living:

These cities have sky-high rents, low availability of one-bed flats, and a heavy price for independence:

London

Average 1-bed rent: £2,100/month Average room rent: £950/month

Solo living is often out of reach unless you’re earning £60K+ annually. Even in cheaper boroughs like Barking or Croydon, one-bed flats still run over £1,500/month.

Bristol

1-bed: £1,350 vs. room: £720

Demand is high and supply is tight, making sharing the go-to option.

Brighton

1-bed: £1,300+ vs. room: £750 Seaside life doesn’t come cheap. Sharing saves around £600/month.

Oxford / Cambridge

These university cities come with elite prices. Even postgrads and professionals struggle to live solo without family help or high-paying jobs.

🏡 More Doable for Solo Living:

In these cities, the cost gap between solo and shared living is smaller—and one-bed flats are easier to find:

✅ Manchester

1-bed: £1,100 Room: £600

Solo living is achievable if you're earning around £35K/year, especially in suburbs like Didsbury or Salford.

✅ Birmingham

1-bed: £950 Room: £550

A top choice for solo renters. The average rent increase to go solo is around £400/month, making it feasible for mid-level earners.

✅ Leeds

1-bed: £850 Room: £500

Rising in popularity for remote workers and creatives, Leeds offers a solid mix of affordability and lifestyle.

✅ Glasgow

1-bed: £800 Room: £475

Scotland’s biggest city has lower rents overall, making solo living much more realistic—especially compared to southern cities.

✅ Newcastle

1-bed: £750 Room: £450

With one of the lowest rent gaps in the UK, Newcastle is ideal if you’re ready to live solo on a modest income.

Use the 30–40% Rule to Plan Your Move

Here’s the bottom line:

If you can increase your current housing budget by 30–40%—and still cover all your other costs—you’re likely in a good place to live on your own.

For example:

- If you’re paying £700/month in a flatshare, make sure you can afford £950–£1,000/month before flying solo.

- Add council tax, bills, and a buffer for food, travel, and unexpected expenses.

Final Thoughts: Is It Time to Live Alone?

Living solo in the UK is an exciting step—but it's a financial commitment that not everyone can swing right now. Whether you’re saving for your own place or sticking with flatmates to make ends meet, the key is to plan smart and know your numbers.

If you’re not quite there yet, iROOMit can help match you with flatmates in your area who fit your lifestyle and budget—without the awkward spare-room interviews.

🔍 Start your search now by downloading iROOMit App and find the right flatshare for your future.